This week was staggeringly bullish for Bitcoin.

Following closely following prior information on MicroStrategy putting $425 million of their depository into Bitcoin, and Jack Dorsey sticking to this same pattern with $50 million of Square's depository, Stone Ridge Asset Management reported an acquisition of 10,000 Bitcoins ($115 million) as a component of their capital administration system.

While Bitcoin's value kept on recuperating, Grayscale got an astounding $1 billion in new venture for its Bitcoin trust in Q3 alone.

What is driving this unexpected institutional in interest in Bitcoin? There are 3 primary components to consider:

1.) Financing costs - with loan fees staying at 0% for years to come, bonds and depositories are not longer a practical generally safe speculation elective

2.) Swelling - the Federal Reserve has made its aim clear to continue to push expansion upwards and keeping in mind that the Treasury will keep on expanding the financial stockpile with extra upgrade

3.) International Instability - as political pressures ascend between U.S. also, China, and the Dollar's save money status is progressively addressed, holding USD-designated resources represents an intrinsic danger

Devotion Digital Assets distributed a point by point report, suggesting a Bitcoin portfolio designation of around 5% to Bitcoin. Devotion presents the accompanying contentions for Bitcoin to occur close by other elective interests in your portfolio.

What are elective speculations?

The broadest characterization of an elective speculation is whatever is anything but a customary venture, like public values, bonds or money.

Present day Portfolio Theory, created by Harry Markowitz in 1952, contends that financial backers can plan an expanded arrangement of ventures that produces greatest returns while limiting unsystematic danger. One of the vital purposes behind remembering options for a portfolio is to build broadening by dispensing to resources or ventures that are driven by various danger and return factors comparative with conventional speculations.

Interest for options developed after the 2008 Financial Crisis given the drawdown in value markets and truly low yields on fixed pay protections. This drove institutional financial backers to search out approaches to relieve deliberate danger and meet yearly bring focuses back.

Why Bitcoin?

The reasoning for designating to Bitcoin is like the reasoning for allotting to elective speculations—portfolio expansion and bring upgrade back.

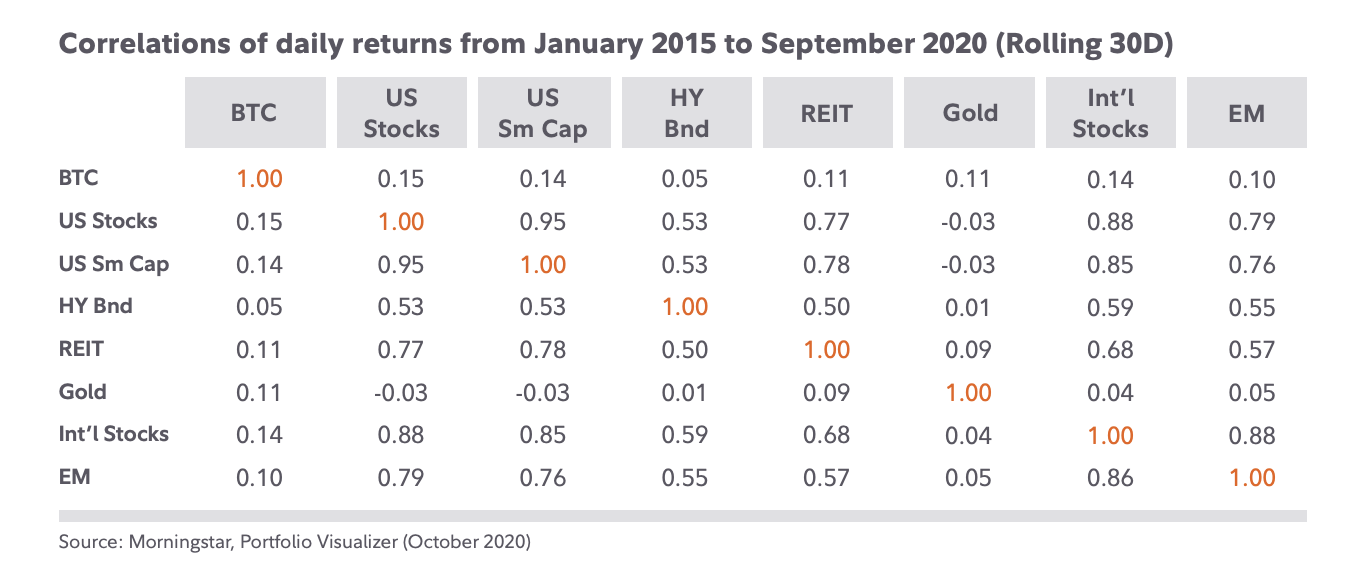

There are not many resources that offer reliable absence of connection to customary resources throughout longer timeframes (e.g., months or a long time), regardless of brief times of development with different resources. Bitcoin's relationship to different resources from January 2015 to September 2020 is a normal of 0.11, on a size of 0 to 1.

Moreover, a persuading story this year has been that bitcoin is a store of significant worth, much the same as gold.

As digital currency framework develops, members in bitcoin markets and customary business sectors have begun to cover. Institutional financial backers can exchange bitcoin prospects and choices on a similar stage they use to exchange subordinates of different resources (e.g., CME, Bakkt). Retail financial backers can purchase and sell bitcoin on specific stages that permit them to exchange stocks (e.g., Robinhood, Square Cash).

The acknowledgment of bitcoin in institutional portfolios today can measure up to the acknowledgment of arising and outskirts values in portfolios in the last part of the 1980s and mid 1990s. The protection from the incorporation of developing business sectors was driven by worries about variables like instability and liquidity.

Bitcoin has a surmised $200 billion market cap. Bitcoin is a small detail within a bigger landscape contrasted and advertises bitcoin could disturb, like stores of significant worth, elective ventures and settlement organizations.

Very rich person Chamath Palihapitiya, clarifies it best:

"The traditional way to deal with contributing for retirement was 60% values and 40% bonds. In the event that your objective was 10% every year this blend took care of business during the 80s, 90s and 00s. Not any longer... Presently, bonds bring zero back. So does 40 go to zero with it? What do we supplant bonds with? One thought could be to expand openness to elective resources. Crypto, vehicles, craftsmanship, baseball cards, and so on A great many people have 0-5% in alts. This designation will likely change if bonds stay at 0...it's simply the math."

Current inclusion of conventional establishments in bitcoin is at the most elevated level it has been. Bitcoin is generally less presented to the delayed financial headwinds that different resources will probably look before very long and a long time, and accordingly could be a possibly valuable and uncorrelated expansion to a financial backers' portfolio tool compartment.

Advantages of Bitcoin Over Other Alternative Assets

Liquidity. Bitcoin exchanges all day, every day with considerable volume is generally simple and modest to enter and exit.

Availability. Certain elective speculations are additionally restricted in their availability, for example funding and private value, land, workmanship and collectibles. Bitcoin is special since it democratizes access.

Low Fees. Elective speculations might be joined by e

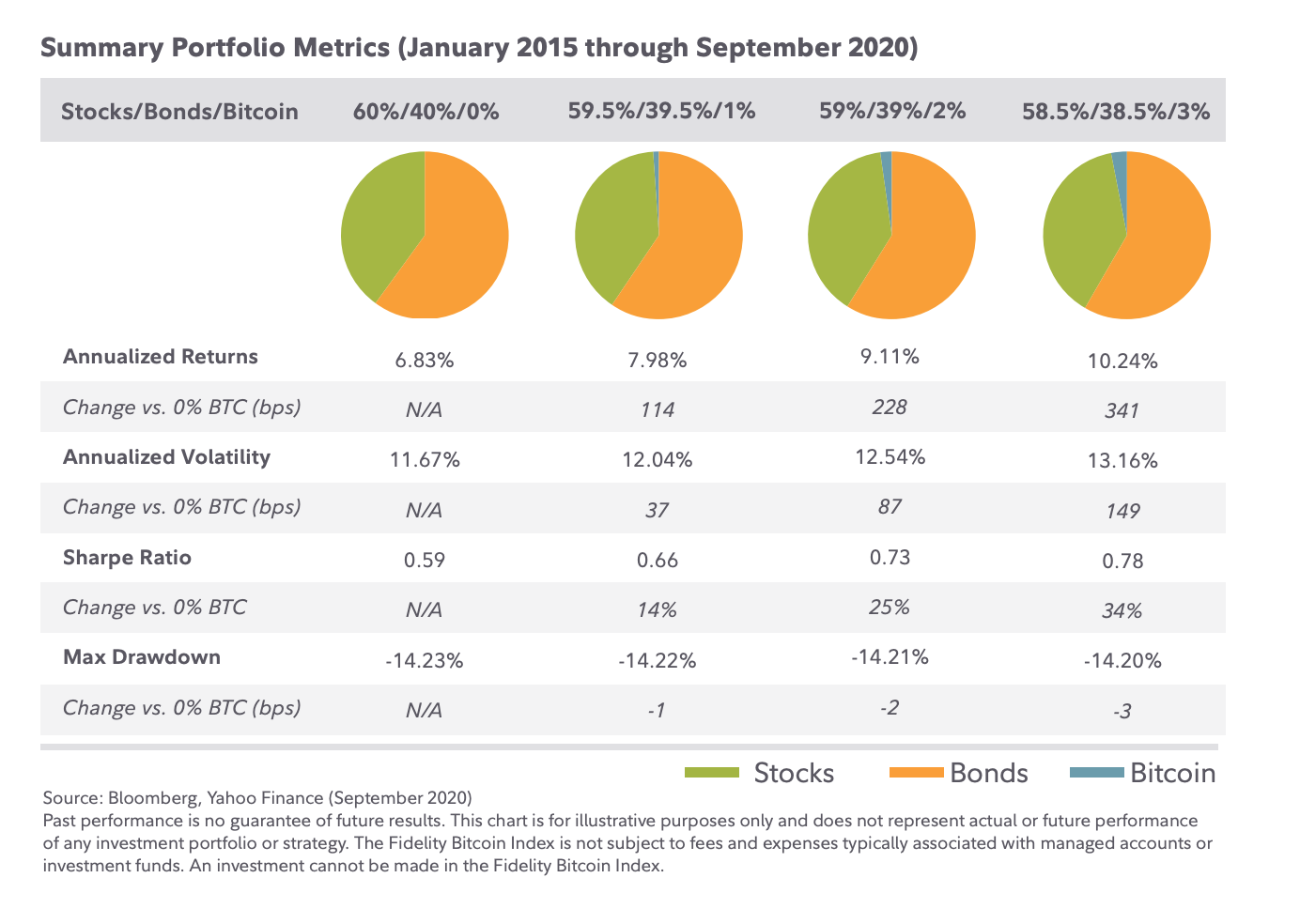

Devotion delineates the effect of a 1%, 2%, and 3% designation to a portfolio with a proportion of 60/40 values and fixed pay, in this manner giving a proposal of 5% as a definitive allotment, and rebalancing as the resource moves in cost.

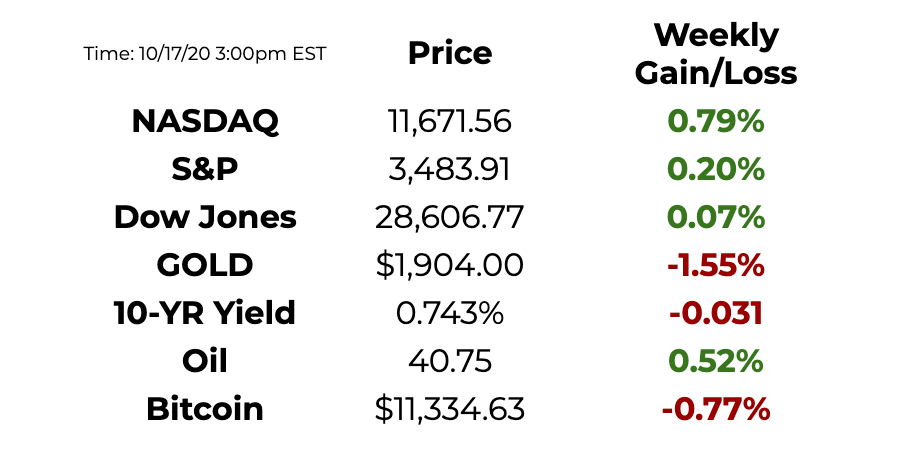

This Week By the Numbers

Public business sectors kept on acting erratically this week. The S&P and the Dow have now gone up and to one side for three back to back weeks, the Nasdaq for four. Extra instability is normal as we get shut to the November third political race date. #Bitcoin is held consistent at above $11,000.

the Nasdaq for four. Extra instability is normal as we get shut to the November third political race date. #Bitcoin is held consistent at above $11,000.

0 Comments